Best Budgeting Apps: A Comprehensive Guide to Managing Your Finances

In today’s fast-paced world, budgeting has become a crucial aspect of maintaining financial stability. Whether you’re trying to save for a vacation, pay off debt, or simply keep track of your spending, the right budgeting app can make all the difference. With a wide range of options available, selecting the right one for your needs is essential. In this article, we will explore the best budgeting apps for 2025, their features, and how they can help you take control of your finances.

Why You Need a Budgeting App

Having a budgeting app allows you to track your income and expenses seamlessly, enabling you to make informed financial decisions. A good app can help you:

-

Set and stick to a budget.

-

Visualize spending patterns with reports and graphs.

-

Track bills and avoid late payments.

-

Plan for future expenses.

By using a budgeting app, you can stop worrying about where your money is going and instead focus on saving, investing, and building wealth.

Key Features to Look for in a Budgeting App

When selecting the right budgeting app, here are some important features to consider:

-

Ease of use: The app should be intuitive and easy to navigate.

-

Syncing with bank accounts: Look for apps that automatically sync with your bank accounts to track expenses in real-time.

-

Customization: The ability to create custom categories and budgeting plans is essential.

-

Security: Make sure the app uses encryption and other security measures to protect your financial data.

-

Support for multiple devices: Choose an app that works across platforms, so you can manage your budget on both mobile and desktop.

Now, let’s take a closer look at some of the best budgeting apps available today.

1. Mint: A Free and Comprehensive Solution

Mint has been one of the most popular budgeting apps for years. It is a free tool that helps users track their expenses, set up budgets, and even check their credit scores. Mint automatically syncs with your bank accounts, credit cards, and bills, making it easy to keep track of all your financial activities in one place.

Features:

-

Budgeting tools and visual graphs

-

Bill tracking and reminders

-

Free credit score monitoring

-

Customizable categories for expenses

Pros:

-

Free to use.

-

Excellent for beginners.

-

Automatic sync with financial accounts.

Cons:

-

Ads can be intrusive.

-

Limited customer support options.

How Mint Helps You Save: The app helps you identify areas where you can cut back on spending, such as dining out or subscriptions, making it easier to reach your financial goals.

For more information on Mint, you can visit their official website.

2. YNAB (You Need a Budget): A Premium Option for Serious Budgeters

YNAB is a premium budgeting app designed for users who want to take budgeting to the next level. It’s particularly helpful for those who need a bit more structure and discipline in their financial planning. YNAB emphasizes the importance of giving every dollar a job, which helps users control their spending and save more effectively.

Features:

-

Goal setting and tracking.

-

Debt payoff tools.

-

Real-time syncing across devices.

-

In-depth reports to track your progress.

Pros:

-

Detailed financial reports.

-

Focus on financial goals and debt reduction.

-

Excellent educational resources.

Cons:

-

$14.99 per month or $98.99 per year subscription fee.

-

Steeper learning curve for beginners.

Why Choose YNAB: If you are serious about budgeting and want to build long-term financial security, YNAB is an excellent option. It provides the structure and tools necessary to achieve your financial goals.

For more details, visit YNAB’s website.

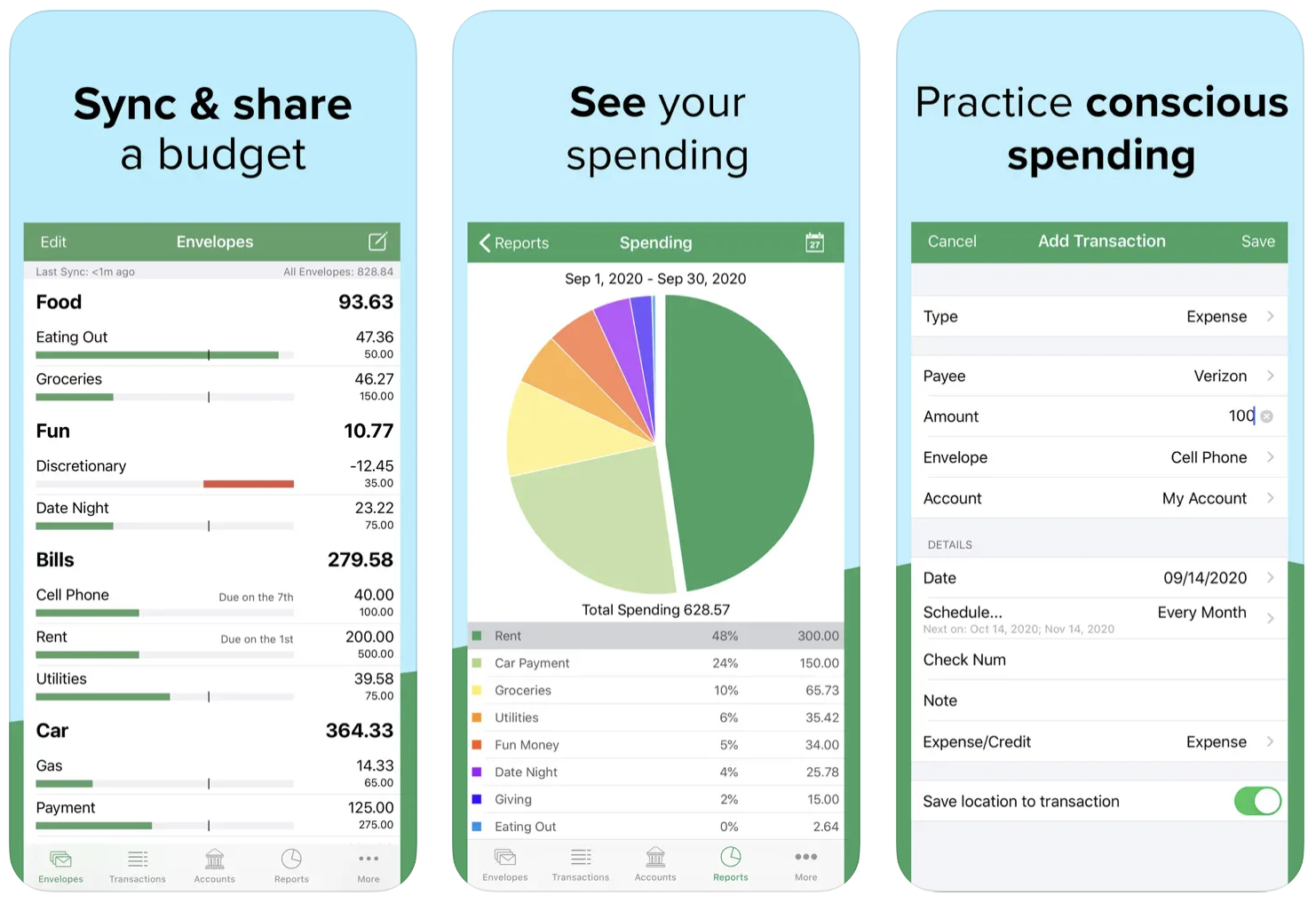

3. GoodBudget: A Simple and Effective Envelope Budgeting App

GoodBudget is a digital envelope budgeting app that helps you plan and track your expenses. Unlike other apps that sync with bank accounts, GoodBudget requires you to manually input your transactions, which some users find helpful for gaining a more intimate understanding of their spending habits.

Features:

-

Envelope-based budgeting system.

-

Syncs across multiple devices.

-

Ability to plan for future expenses.

-

Detailed reports and visual tracking.

Pros:

-

Simple interface.

-

Good for people who prefer hands-on budgeting.

-

Syncs across multiple devices.

Cons:

-

Lacks automatic syncing with bank accounts.

-

No bill reminders.

Why Use GoodBudget: If you like the idea of envelope budgeting but want the convenience of a mobile app, GoodBudget is a great choice. It helps you manage your money while keeping things straightforward.

Explore more about GoodBudget on their website.

4. PocketGuard: A Budgeting App That Tracks Your “In My Pocket” Money

PocketGuard is a budgeting app that helps you control your spending by showing you how much disposable income you have after covering bills and savings goals. The app connects to your bank accounts and credit cards to calculate the money available for spending, which helps prevent overspending.

Features:

-

Automatic bill and subscription tracking.

-

Cash flow analysis.

-

Set savings goals and track progress.

-

Easy-to-read reports.

Pros:

-

User-friendly interface.

-

Helps track subscriptions to avoid unnecessary charges.

-

Available in both free and premium versions.

Cons:

-

Limited features in the free version.

-

Less customization than other apps.

How PocketGuard Helps You Save: By showing exactly how much you have “in your pocket,” PocketGuard helps you avoid spending more than you can afford, ensuring you save more in the long run.

Visit PocketGuard for more details here.

5. EveryDollar: A Simple Budgeting App from Dave Ramsey

EveryDollar, created by financial expert Dave Ramsey, is a straightforward budgeting tool designed to help you track your expenses and stick to a monthly budget. It uses a zero-based budgeting system, meaning you assign every dollar of your income to a specific expense, savings, or debt repayment category.

Features:

-

Easy-to-use interface.

-

Customizable expense categories.

-

Syncs with bank accounts (with a premium version).

-

Debt tracking tools.

Pros:

-

Simple, easy-to-understand system.

-

Free version available.

-

Great for users following the Dave Ramsey method.

Cons:

-

Premium version required for automatic syncing.

-

Lacks some advanced features like investment tracking.

Why Choose EveryDollar: If you prefer a simple approach to budgeting and are familiar with the Dave Ramsey system, EveryDollar is a solid choice for managing your finances effectively.

Learn more on EveryDollar’s website here.

Conclusion: Choosing the Right Budgeting App

The best budgeting app for you will depend on your financial goals and personal preferences. Whether you’re looking for something simple and free, like Mint, or a more structured tool like YNAB, there’s an app out there to help you manage your finances better.

Key Takeaways:

-

Choose an app that aligns with your financial goals.

-

Consider the features that are most important to you (automatic syncing, budget categories, etc.).

-

Many apps offer free trials, so don’t hesitate to try a few before settling on one.

With the right budgeting app, you can take control of your finances, avoid debt, and work toward achieving your financial goals. Get started today and see the difference it makes!

FAQs

What is the best budgeting app for beginners?

Mint is often considered the best option for beginners because it’s easy to use and free.

Can I sync my bank account with these apps?

Yes, most budgeting apps, such as Mint and YNAB, offer bank account syncing to track your transactions automatically.

Are these budgeting apps secure?

Yes, most budgeting apps use encryption and other security measures to protect your data. Always check the app’s security features before connecting any sensitive financial information.